Calculating Tariffs to the USA: Difference between revisions

No edit summary |

No edit summary |

||

| (One intermediate revision by one other user not shown) | |||

| Line 2: | Line 2: | ||

This guide exists for American customers to calculate duties and tariffs on our products before placing an order. | This guide exists for American customers to calculate duties and tariffs on our products before placing an order. | ||

Orders to the USA with a total value under $800 USD will '''not''' | Orders to the USA with a total value under $800 USD will '''not''' be charged duty or tariff. In this case, you will not have to pay anything beyond what you pay when you complete your order on our website. | ||

== Step 1 - Look up Duty Value in the Harmonized Tariff Schedule == | == Step 1 - Look up Duty Value in the Harmonized Tariff Schedule == | ||

| Line 65: | Line 65: | ||

* If you can't use the online search, a printable list of all HS Codes and their Chapter 99 heading can be found [https://hts.usitc.gov/view/China%20Tariffs?release=2020HTSARev16 here] | * If you can't use the online search, a printable list of all HS Codes and their Chapter 99 heading can be found [https://hts.usitc.gov/view/China%20Tariffs?release=2020HTSARev16 here] | ||

* The chapter 99 heading corresponds to a Tariff List (1, 2, 3, etc.) in the above table and you can determine the tariff rate from there | * The chapter 99 heading corresponds to a Tariff List (1, 2, 3, etc.) in the above table and you can determine the tariff rate from there | ||

== Step 3: Calculate == | |||

Once you have the rates of all applicable duties and tariffs, you can multiply the item's cost by the duty rate. For example, if your $100 item has a %7.5 duty rate and a %25 tariff, you can expect to be charged a $7.50 duty and $25 for the tariff before receiving your package. | |||

Latest revision as of 15:43, 21 August 2020

This guide exists for American customers to calculate duties and tariffs on our products before placing an order.

Orders to the USA with a total value under $800 USD will not be charged duty or tariff. In this case, you will not have to pay anything beyond what you pay when you complete your order on our website.

Step 1 - Look up Duty Value in the Harmonized Tariff Schedule

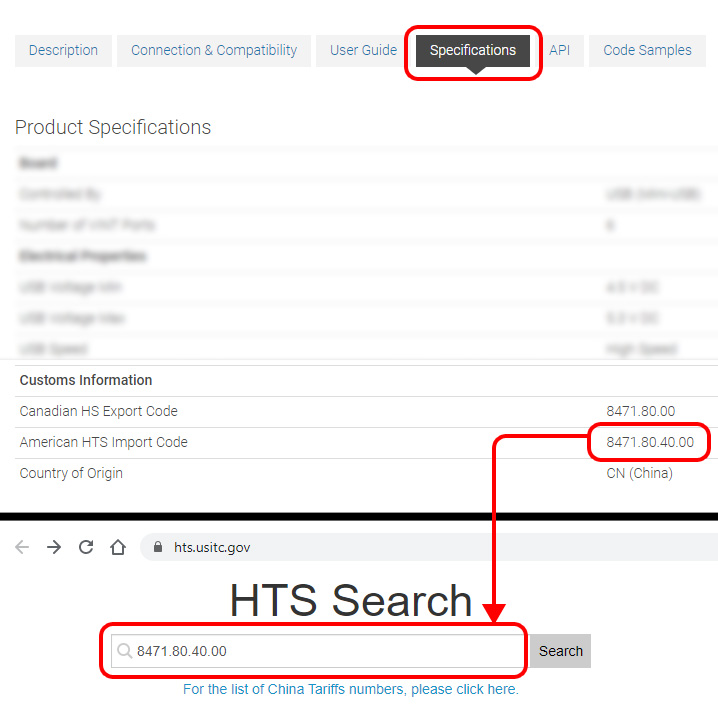

- Go to the page for your Phidgets product and click on the Specifications tab

- Copy the American HTS Import Code listed there

- Go to https://hts.usitc.gov

- Paste the import code into the search bar

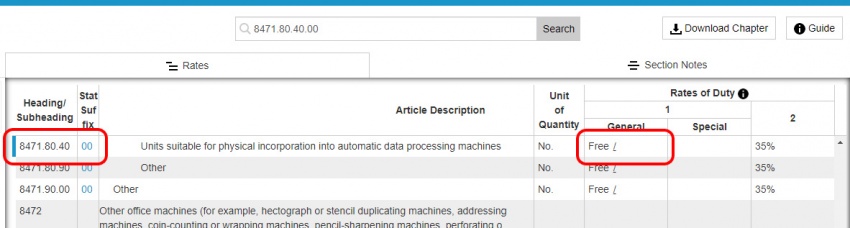

- Look at the "Rates of Duty" column

- The majority of products will be under the 'General' rate of duty column 1, as pictured

- Some products may be duty-exempt under NAFTA or other treaties depending on country of origin - these are specified in the Special column. Products from certain countries such as North Korea or Vietnam are taxed at the rate shown in column 2. For more details on these extra columns, see this document.

You now have the base Duty for this product.

Step 2 - Check For Additional Tariffs

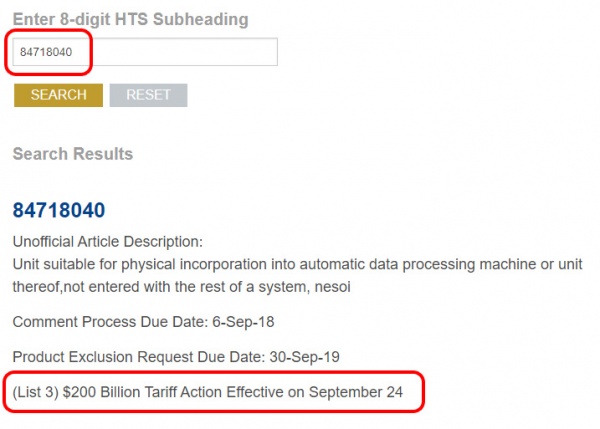

The US government has placed tariffs on certain products originating from China. There are several lists taxed at different rates that your product might fall under. Go back to the specifications for your product and check the Country of Origin. If it says "China", continue with the steps in this section.

- Go to this page and type in the first 8 digits of the 10-digit American HTS Import code at the bottom of the page.

- This will say whether the code is under tariff and which list (List 1, List 2, List 3, List 4A, List 4B) it is on

- The tariff rate for each list can be found in the following table:

| List | Chapter 99 Heading | Tariff Rate | Effective Date |

|---|---|---|---|

| List 1 | 9903.88.01 | 25% | July 6, 2018 |

| List 2 | 9903.88.02 | 25% | August 23, 2018 |

| List 3 | 9903.88.03, 9903.88.04 | 25% | September 24, 2018 |

| List 4A | 9903.88.15 | 7.5% | February 14, 2020 |

| List 4B | 9903.88.16 | N/A | List not active |

- If you can't use the online search, a printable list of all HS Codes and their Chapter 99 heading can be found here

- The chapter 99 heading corresponds to a Tariff List (1, 2, 3, etc.) in the above table and you can determine the tariff rate from there

Step 3: Calculate

Once you have the rates of all applicable duties and tariffs, you can multiply the item's cost by the duty rate. For example, if your $100 item has a %7.5 duty rate and a %25 tariff, you can expect to be charged a $7.50 duty and $25 for the tariff before receiving your package.